Due diligence is a mandatory step in any M&A transaction. The buyer company’s experts study all the background of the selling company to understand the nature of its activities, its value to their company, and potential benefits. However, this process is very complex and tedious, and only a small percentage of all deals are effective if done traditionally. However, virtual due diligence data rooms help to improve the efficiency of the transaction, making it faster, livelier, and more productive. In this article, we will explain exactly how VDRs help with DD.

What is the due diligence process?

Due diligence is a detailed review of a company’s confidential data, to accurately estimate the amount it will take to finance it, as well as the viability of the company, checking for pitfalls. However, studying all that volume of information, including financial and legal documentation, trade secrets and corporate records requires not only concentration and attention, but also a lot of time and effort, so in the past, the entire operation took more than one month. With the development of technology and digital programs, due diligence, as well as many other business operations began to move online. This method of DD has both positive aspects and disadvantages, for example, now the entire check can be done remotely, but it may not be safe for the confidential data of the company-seller if you do not use a reliable platform. That’s exactly what virtual data rooms were created for.

Why use a virtual data room m&a for due diligence?

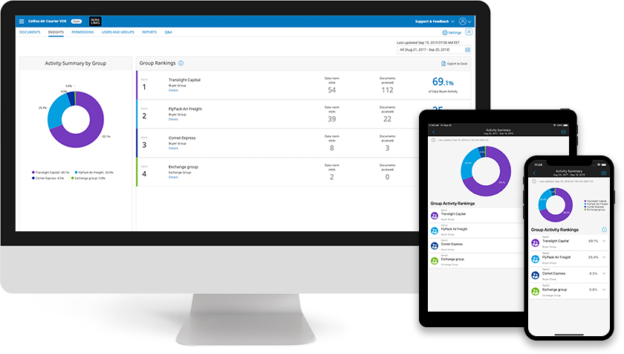

Virtual data room is known in the marketplace as the most secure way to store and exchange documents during various business transactions. VDR is used for mergers and acquisitions, fundraisers, IPOs and is the perfect place to do due diligence. VDR not only automates a lot of routine work, but also facilitates interaction between parties to a transaction remotely, and of course, uses advanced security features. Learn more about data room features below:

- Strict security standards

One of the main reasons why a virtual data room is so trustworthy is the fact that it is a certified solution according to international security standards. The best certifications a VDR provider can provide are COC1 or 2, ISO27001, GDPR, or if it’s a specific industry, but industry standards like HIPAA for medical facilities.

- Powerful security features

Data rooms provide an extra layer of security to help protect your documents from insider threats such as data breaches. These features include:

- Access Permission Control – Set individual or group permissions to allow third-party users to access documents

- Document Actions Control – allows you to block copying, printing, forwarding, uploading, editing, screenshotting or partial visibility of a document. Thus you define the security level of each document by yourself

- Dynamic watermarks – they show information about users, their email name, time and dates they accessed the document, and what they did with it

And that’s not all the features that VDR has to offer you, these are just the basic features

- Simplified Data Management

During due diligence, a vendor needs to ensure that all data is properly organized so as not to delay the validation process. VDR allows you to organize all the data faster and more efficiently with features like:

- Mass Download, Multi-Format – Load all your data at once in one click. No need to format files in a tedious format beforehand

- Automatic indexing – logically organizes all files as soon as they hit the space

- Navigation -Smart search and filtering will cut down on the time it takes to find the right document